Six Questions to Ask Before Buying Another Carbon Offset

Introducing a new approach to carbon offsetting that prioritizes quality, innovation, and equity

With Earth Day just around the corner, I expect we will see a flurry of new net-zero commitments. Many of these net-zero plans, unfortunately, will depend heavily on low-quality carbon offsets. In previous posts, I have talked about the major inherent flaws in most carbon offsets and the steps that businesses can take to start shifting away from these flawed offsets. Since then, the latest carbon offset fail involves potentially millions in meaningless forestry carbon credits sold to major corporations by a large environmental NGO, triggering a major internal investigation. To be clear, failures like this do not fall on any one individual organization. The problem with carbon offsetting is systemic and efforts to claim carbon neutral status have resulted in a race to the bottom for cheap, but ineffective carbon offsets. Hopefully, the relentless news coverage on carbon offset failures will shake the tree loose of bad actors, and the good ones will hang on. Moving forward, what we really need is to reform voluntary carbon offset markets and prioritize quality improvements before scaling up a broken system that the Taskforce on Scaling Voluntary Carbon Markets believes could grow to be a $50 billion market by the end of the decade.

These reforms, if they ever happen, will take time. Net-zero pledges will continue growing, and companies will still depend on carbon offset markets to meet their commitments. What companies, institutions, and other offset buyers should do now is pause and rethink their approach to carbon offsets entirely. Having navigated the opaque world of carbon offsets myself, I understand how unregulated, voluntary carbon markets can feel like the Wild West. In response to this, I developed a mental model to help me make sense of carbon offsets and evaluate them more holistically in terms of quality, innovation, and equity.

So today, I’m excited to introduce my model - which I’m calling the MOBILE Framework - to help companies and institutions rethink carbon offsetting and fundamentally make better offset purchase decisions. I hope this framework can serve as a starting point for evaluating options, screening out low quality offsets, and targeting offsets that catalyze innovation and help address inequities. I tried to make it comprehensive while keeping it simple and approachable. With carbon market failures piling up, there is no better time to change course on how your company or institution approaches carbon offsetting. It starts with asking six key questions over the course of three simple steps. Here is an infographic of the MOBILE Framework (feel free to share it!), which I explain in more detail below.

Digging into the MOBILE Framework:

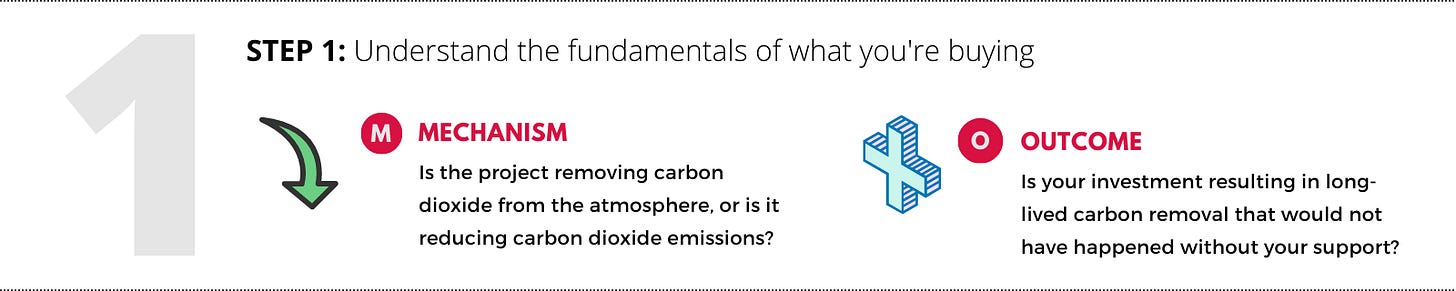

Step 1: Understand the fundamentals of what you’re buying.

Mechanism: What is the project’s underlying carbon mitigation approach?

Does the project remove carbon dioxide from the atmosphere (carbon dioxide removal, or CDR) or does it avoid or reduce new carbon dioxide emissions (emissions avoidance or reduction)? It’s important to distinguish between the two. Since CDR removes CO2 from the atmosphere, it can be reasonably accounted for in net zero targets. Offsets that avoid or reduce emissions (e.g. point-source carbon capture and storage on an industrial facility) are fine, especially if they are particularly innovative and support technologies necessary for long-term deep decarbonization, but they should be reported separately from CDR purchases. Ultimately, though, companies need to start making a wholesale shift towards CDR to make good on their net-zero targets.

Outcome: Is the outcome of your offset purchase additional and permanent?

This element is critical and unfortunately, many offset projects don’t measure up. There are two crucial concepts involved. The first, and most important, is additionality. Is your offset purchase going towards CDR or avoided emissions that would not have otherwise happened without your investment? If a project cannot demonstrate additionality, there is no point of supporting it. Swipe left, it’s time to move on.

The second concept gets at permanence. Does the project result in short-lived or long-lived reduction or removal of CO2? Most offsets ultimately result in short-lived avoidance, reduction, or removal of CO2. We’ll get to quantifying this later, but the gist is that we need to shift to more permanent forms of CDR that store carbon away for centuries or longer. If the offset project cannot demonstrate permanence (e.g., if there is a high risk the project’s CO2 will be released in the near-term), we should make plans to switch to more permanent alternatives in the future and account for the switching costs.

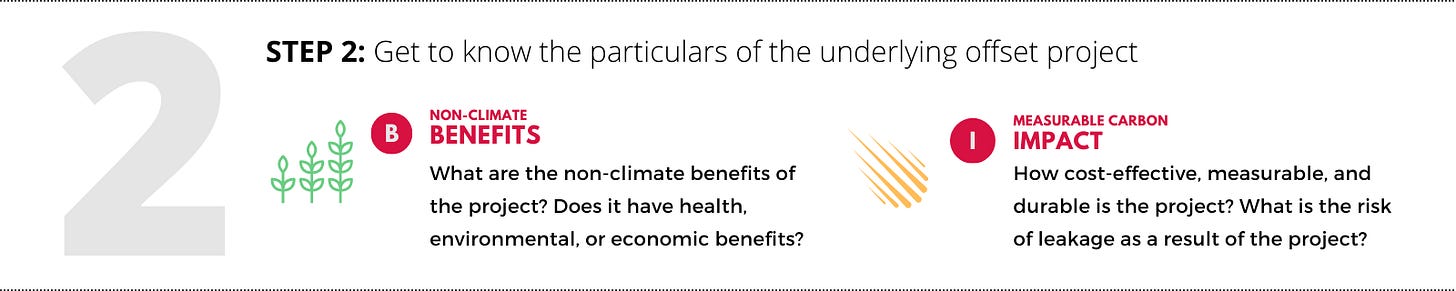

Step 2: Get to know the particulars of the underlying project.

Benefits: What are the non-climate benefits (or co-benefits) of the project?

Beyond the advertised impact on carbon reduction and removal, what benefits do carbon offset projects offer? For example, a project could improve soil heath and crop yields, protect biodiversity, reduce runoff or erosion, or mitigate the impact of natural disasters. It is worthwhile to understand these potential “co-benefits” when holistically evaluating a carbon offset project. However, these claims should be closely scrutinized as they can be hard to measure and validate. Ultimately, a project’s enticing co-benefits should not be a reason to overlook potential weaknesses in other areas.

Impact: What is the quantifiable carbon impact this project will have?

There are several parts to this question that can help you categorize, quantify, and even score the potential carbon impact of offset projects:

Measurability: How measurable is the carbon mitigation potential? For nature-based CDR solutions like forestry offsets, it can be hard to accurately measure how much CO2 has been removed by an initiative to protect a forest. For engineered solutions such as direct air capture, the carbon sequestered is ostensibly easier to quantify, however, we also have to account for the carbon intensity of the energy inputs required to power those processes.

Permanence: Going back to timeframe, how long is the captured CO2 likely to be stored for? 10 years? 100 years? 1000+ years? If it’s less than 100 years, it is not particularly durable. Carbon emitted into the atmosphere can stay there for centuries, which means we need to store away carbon for at least that long. Permanence is often ignored when pricing carbon offsets. Luckily, Carbon Plan offers a handy calculator for understanding a truer price of projects with limited permanence.

Volume and price: What is the advertised volume of CO2 being removed or reduced/avoided? What is the price per ton of CO2 removed or reduced/avoided? Given critical quality and measurement differences inherent in permanence, additionality, and leakage, the advertised price per ton alone is not a particularly useful apples-to-apples comparison across projects. Be careful not to rely too heavily on the stated “price per ton,” as it is often not reflective of the actual cost of permanently removing and sequestering carbon from the atmosphere. We need to get accustomed to paying more to effectively remove and store carbon. Today’s prices do not reflect the true cost (spoiler: it should cost a lot more than your Netflix subscription).

Leakage: What is the risk of a CDR project creating climate harm elsewhere? For example, does protecting one forested area lead to accelerated logging in unprotected areas somewhere else?

Verifiability: What have third-party verifiers and evaluators said about this project? Treat their findings as just one data input among many, as verifiers are not regulated and may have conflicting incentives when reviewing projects.

Transaction costs: How much of the funds goes towards implementing a project or deploying the technology vs. marketplace fees and intermediaries?

Step 3: Try to catalyze broader change rather than just negate your carbon ledger.

Learning: How can we improve technologies and catalyze new markets?

One of the biggest disappointments when companies buy bargain-basement offsets is the lost opportunity to shape new climate technologies, innovations, and markets. Combating climate change is going to require unprecedented levels of innovation and technology, and buying offsets should support that endeavor. It is worth considering if a project’s underlying innovation or technology is relatively nascent, and if your purchase would help stimulate learning that could benefit that technology or industry in the long-term. New carbon removal and carbon utilization innovations require investment to conduct research and testing, share best practices, iterate on the technologies, encourage new competition, increase production volumes, and bring down costs to achieve scale. None of that happens without investment, and companies and institutions can make a valuable contribution in catalyzing that learning for the broader climate fight by supporting promising, emerging CDR technologies.

Equity: How does the project address inequities?

There are both micro and macro level considerations to this critical, often overlooked, question.

At a micro-level, how were local and typically marginalized communities involved or engaged in the project? As bystanders or partners? This question goes beyond the co-benefits discussed above and seeks to assess the implications of those benefits on often underrepresented communities. For instance, an agriculture-based offset project may increase crop yields while ignoring the working conditions of workers on that farm. A forestry project may protect biodiversity, but limits access to the land of indigenous peoples who have depended on it for centuries. Properly engaging stakeholders can help create equitable economic opportunities, enhance local ownership, and advance environmental justice.

At a macro-level, how might you be participating in shifting the burdens and risks of CDR to poorer countries in the Global South for emissions created in the Global North? For example, what are the broader economic, political, social, cultural, and land use implications of a large-scale forestry offset project that a U.S. company creates in Tanzania? How might the inability to use that land affect the agency of local populations and alter national politics?

If you ran most traditional carbon offset projects through this framework, I believe few would make it through without raising significant questions. Today’s supply of offsets that prioritize quality, innovation, and equity is extremely thin. Ideally, future voluntary carbon markets will look very different than they do today. That future should be shaped by climate scientists, academics, governments, businesses, carbon removal entrepreneurs, and community-based organizations to fundamentally rethink carbon markets that optimize for quality, transparency, and appropriate pricing. We need to reimagine traditional offset markets and move towards a credible, well-regulated “carbon removal as a service” industry.

We need to reimagine traditional offset markets and move towards a credible, well-regulated “carbon removal as a service” industry.

Whatever the future looks like, companies can initiate this change now, supporting good actors in a difficult market while avoiding becoming victim to the latest carbon offset flop. By investing in high-quality carbon offset projects that prioritize innovation and equity, companies can fundamentally shape a thriving carbon removal market that can replace the currently flawed offset universe. I believe the MOBILE Framework can serve as a starting point for that change.

Looking ahead, I am excited to work with companies and institutions to stress test and iterate on this framework, and collaborate with experts and stakeholders to eventually translate it into a scorecard or evaluation tool. Please reach out to me if you have feedback or want to work together to leverage this framework for your future offset purchases. And please share this post or the graphic below on social media or with others who might find it useful!

To receive regular ideas and analyses on carbon removal and the new carbon economy, please subscribe below. If you enjoyed this post, please share it with friends. And if you’d like to get in touch, you can find me on LinkedIn and Twitter.